(1).png)

如何创建加密货币

摘要

你有没有想过创建自己的数字货币像比特币这样的加密货币通过提供去中心化的安全方式来存储价值和促进交易,从而彻底改变了金融世界 。

币界网报道:

赞

赞

分享

.png) 1013

1013

收藏

收藏

发表评论

暂无评论

相关阅读

币界百科

币界资讯

亿万富翁兼 Gemini 联合创始人泰勒·文克莱沃斯 (Tyler Winklevoss) 表示,银行业巨头摩根大通 (JPMorgan) 正试图让金融科技和加密货币公司破产。

区块链

2025-07-27 17:50:10

Tornado Cash 案已扩展到早期投资者,标志着司法部在法律方面的重大转变。

区块链

2025-07-27 15:33:07

在虚拟币交易领域,各交易所竞争激烈。2025年最新的虚拟币交易所排行榜备受关注。币安作为全球最大的虚拟币交易所,拥有庞大用户群、广泛交易对和完善安全措施。Coinbase以易用性和合规性闻名。OKX提供多种交易产品和低费用。还有Kraken、Huobi等也各具特色。这些交易所凭借安全性、可靠性等优势,代表着行业发展趋势,投资者需DYOR后谨慎选择。

区块链书籍

2025-03-08 10:24:18

在加密货币的世界里,DOG币凭借其独特的魅力吸引了众多投资者的目光。而DOG交易平台则是进行DOG币交易的重要场所。本文将为你详细介绍DOG交易平台的相关信息,包括DOG币的特点、交易平台的选择要点等。让你在交易过程中少走弯路,更加从容地应对市场变化。无论你是新手还是有一定经验的投资者,都能从中获取有价值的信息,提升自己的交易能力。

数字货币百科

2025-03-07 17:33:38

在加密货币市场中,ICX杠杆是一个备受关注的话题。对于投资者来说,了解ICX杠杆的玩法和策略至关重要。本文将深入剖析5大ICX杠杆玩法,为你全面解读ICX市场,无论是新手小白还是经验丰富的投资者,都能从中获取有价值的信息,助你在投资之路上迈出更稳健的步伐。

区块链书籍

2025-03-07 16:35:02

在科技与经济数字化浪潮下,虚拟货币影响力日益扩大。2025年虚拟货币排行榜前十备受关注。比特币作为开山鼻祖,以稀缺性和高安全性稳居榜首,市值约1.98万亿美元。以太坊是智能合约和去中心化应用核心平台,市值378.71亿美元。莱特币交易快、费用低,适合小额支付。币安币作为币安交易所原生代币,应用场景丰富。这些虚拟货币各有特色,未来发展值得期待。

区块链百科

2025-03-07 15:42:14

在加密货币的投资浪潮中,HOGE合约与KAIA杠杆成为众多投资者关注的焦点。HOGE合约在市场上有独特的运行机制,而KAIA杠杆更是因币安上线相关交易对及高达75倍的杠杆吸引大量目光。了解它们能让你在加密交易中更好地把握机会。不过,加密交易的永续合约和杠杆交易有着显著区别,如资金来源、杠杆率计算、风险管理等方面。DYOR,深入研究这两者,才能在市场中更从容地做出决策,降低风险,获取更好的投资体验。

交易所百科

2025-03-07 13:24:00

随着加密货币的兴起,越来越多的诈骗行为也开始在这个新兴市场中浮现。近年来,许多投资者由于资金被非法平台卷走而蒙受损失,因此,识别非法交易所的能力至关重要。在本文中,我们将分享识别非法区块链交易所的五个关键特征,帮助你保护自己的资产安全。

交易所知识

2025-04-09 11:24:11

在加密货币市场蓬勃发展的今天,币圈交易所的选择至关重要。2025年排名前十的币圈交易所各具特色。币安作为最大的全球加密货币交易所,提供广泛的加密货币和交易对,流动性强且生态完善;Coinbase以易用性和安全性著称,适合新手;FTX快速崛起,专注衍生品交易和创新产品;火币是老牌交易所,提供多样交易服务;OKX因杠杆交易和期货市场闻名;Crypto.com是综合性平台;Kraken安全性高且支持广泛加密货币;Gemini合规性强;Gate.io提供丰富功能和众多加密货币;BitMEX则专注永续合约和杠杆交易

矿业知识

2025-03-04 10:00:05

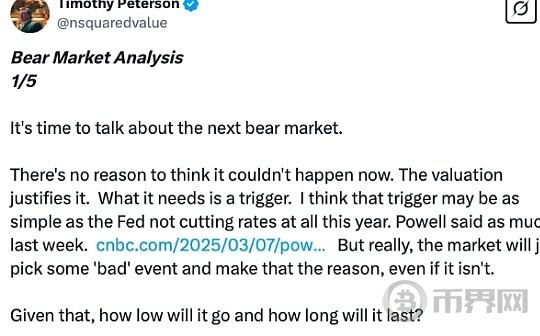

网络经济学家蒂莫西·彼得森的模型表明,比特币可能在下一次熊市中触底至 57,000 美元,但他表示,这种可能性不大,因为太多投资者“像秃鹫一样盯着比特币”。

比特币新闻

2025-03-10 10:31:31

在当今的加密货币领域,BLOK平台与COMBO交易所官网备受关注。BLOK平台相关的BLOK币有其独特的市场表现,今日价格约为0.00041美元,总市值达6.00亿人民币。而COMBO币虽在过去24小时内下跌了15.8%,但其流通总量已达7105.17万个。COMBO目前仅在一家交易所上架,不过其官网提供丰富信息,白皮书介绍了项目愿景和技术细节。探索BLOK平台与COMBO交易所官网,能让我们更深入了解加密货币的发展态势与潜力,把握行业动态。

交易所知识

2025-03-03 18:53:18

在加密货币市场蓬勃发展的当下,WZRDs交易所官网与MAN交易所官网备受关注。WZRDs交易所有其独特的交易机制和服务模式,为众多投资者提供了数字资产的交易渠道。而MAN币依托的MAN交易所官网,其发行的MAN币基于以太坊ERC20标准,致力于为用户打造便捷、高效的数字货币交易体验。官网不仅能查看实时价格、交易数据等信息,还提供注册登录、交易、挖矿、钱包存储等功能。这两个交易所官网究竟谁更具优势,又分别适合哪些类型的投资者?本文将带你一探究竟,为你全面剖析这两个交易所官网的特点与差异,帮助你在加密货币的世

交易所知识

2025-03-03 21:17:39

推荐专栏

Fully On-Chain & AI-Powered Meme Trading | #Xbit #DEX #Web3 | English: @XBITDEX | Chinese 华语 : @XBITDEX_ZH | Support: @XbitHelpDesk

热门币种

更多

币种

美元价格

24H涨跌幅

热搜币种

更多

币种

美元价格

24H涨跌幅

最新快讯

更多

2025-07-27 19:26:46

2025-07-27 19:20:22

2025-07-27 19:17:08

2025-07-27 18:51:53

2025-07-27 18:51:50

2025-07-27 18:25:57

2025-07-27 17:31:56

苹果下载

苹果下载

安卓下载

安卓下载